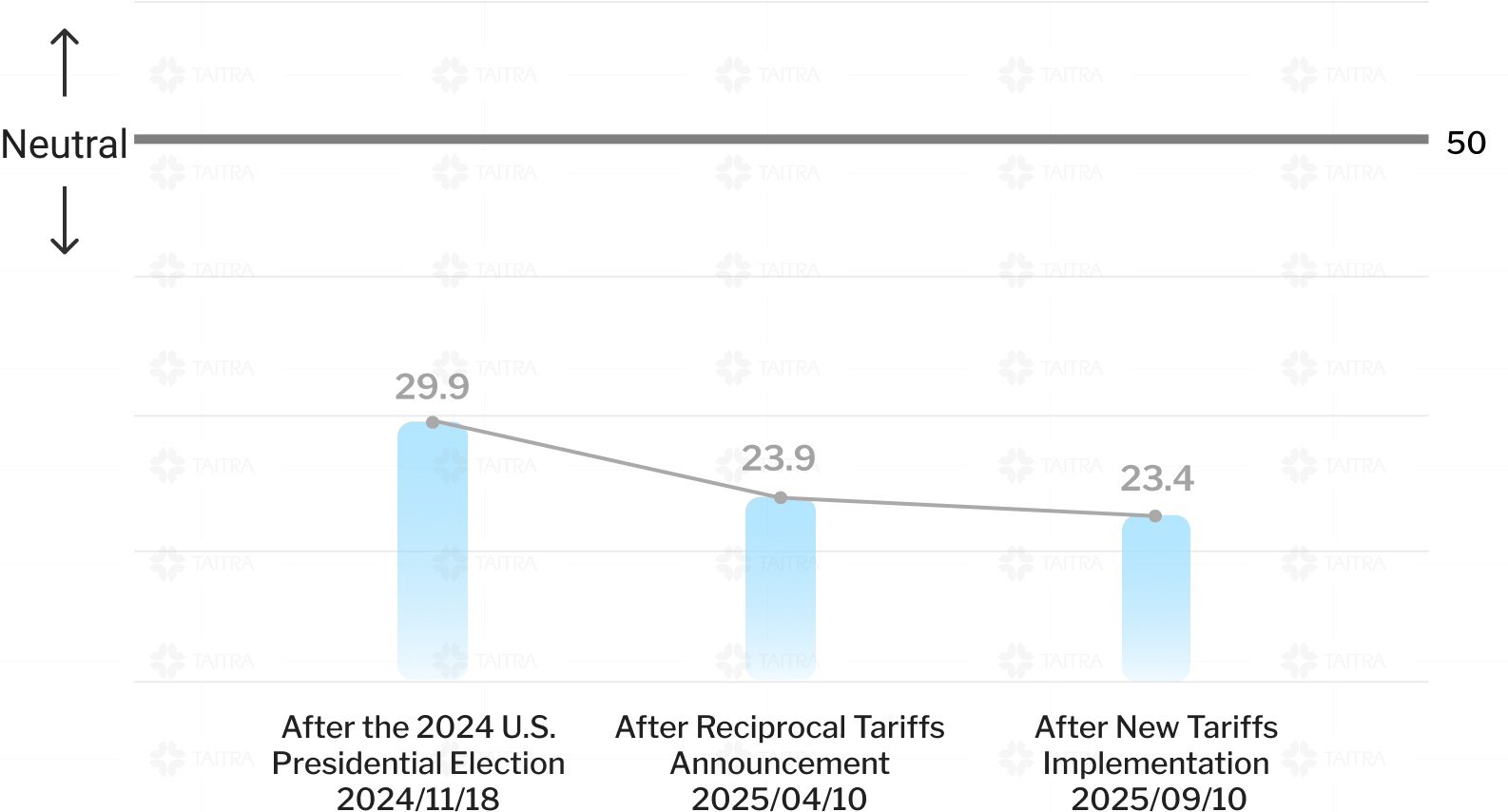

Survey Date:2025/09/10

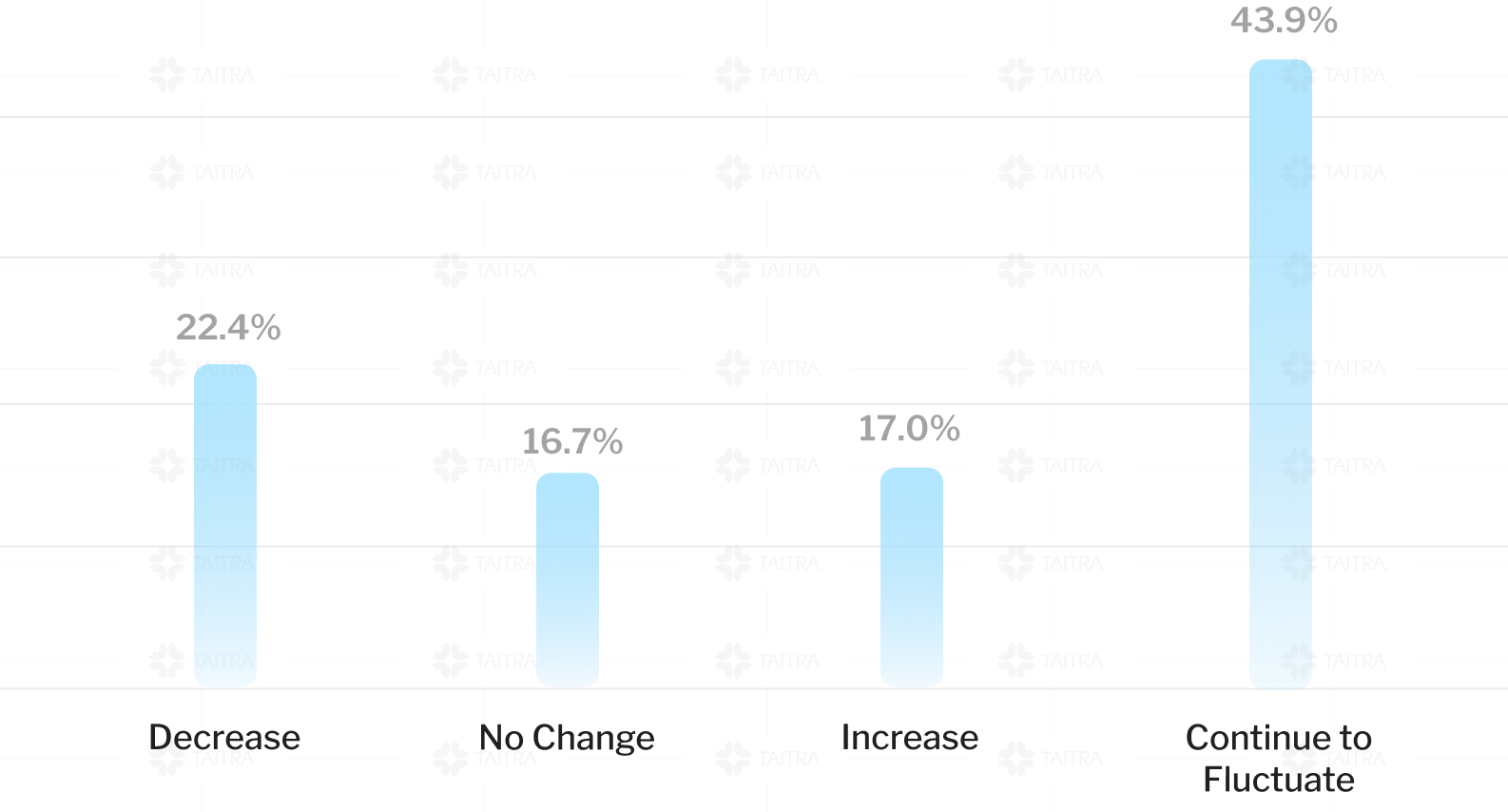

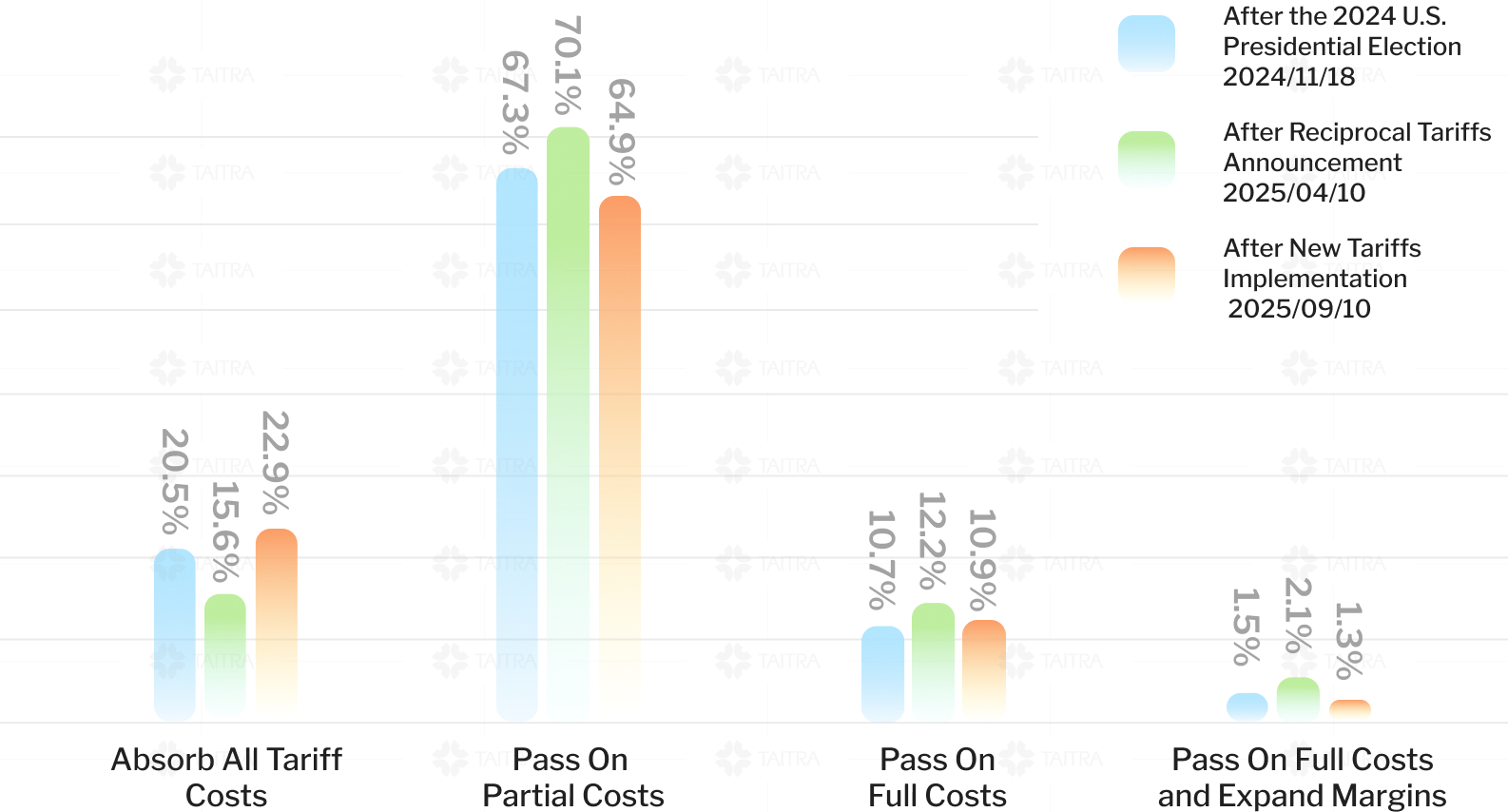

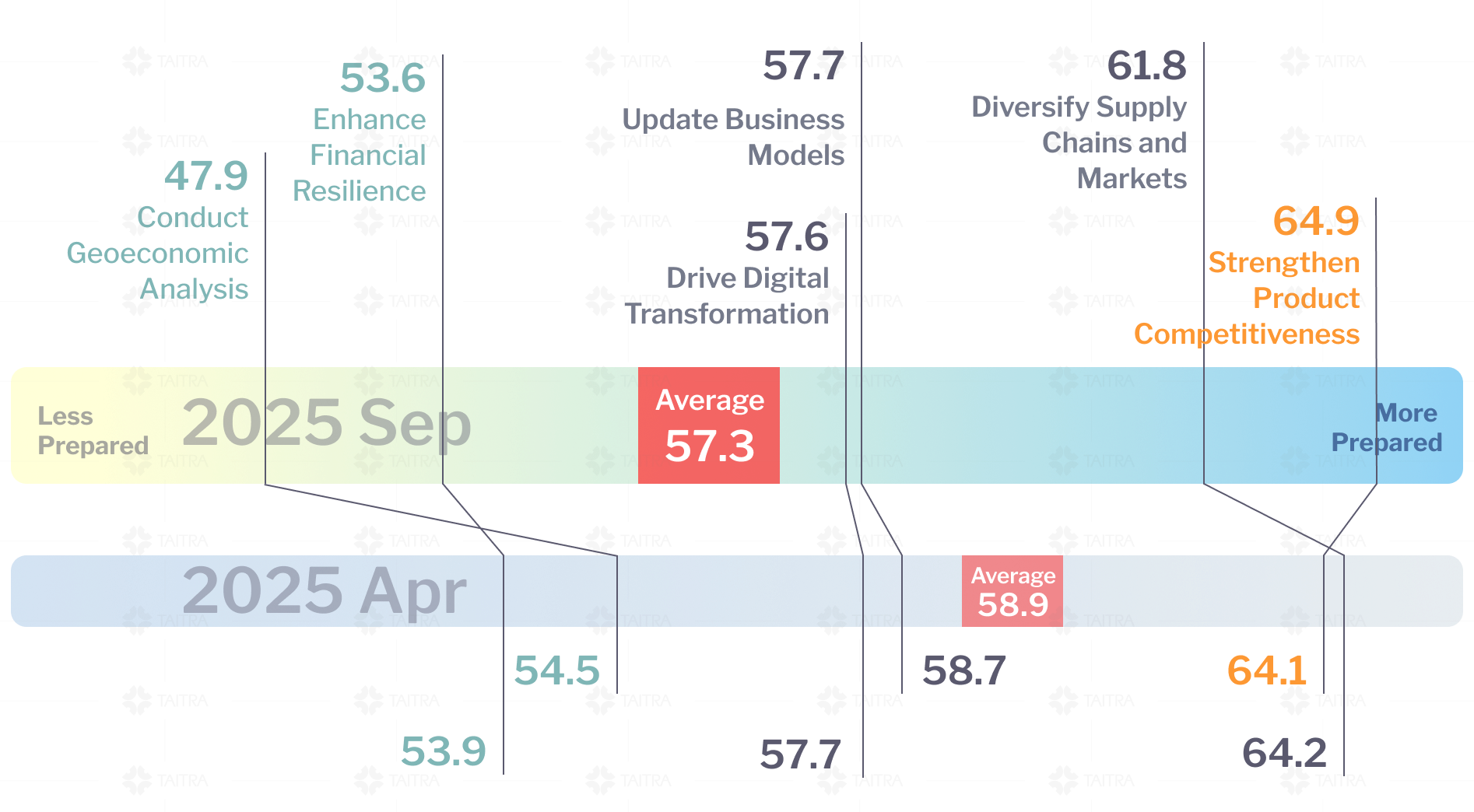

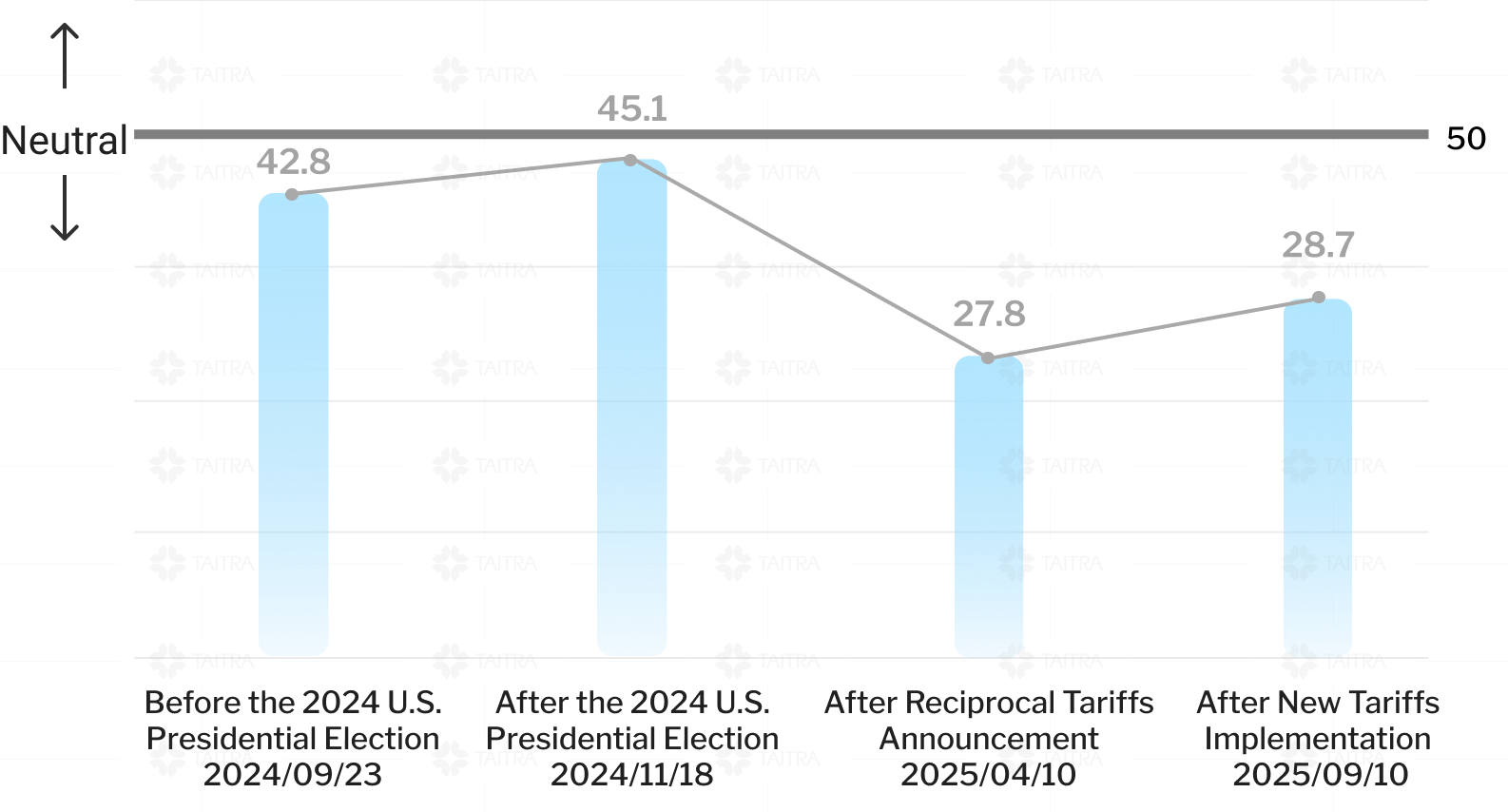

A significant shift in corporate outlook has occurred since the new tariffs took effect.

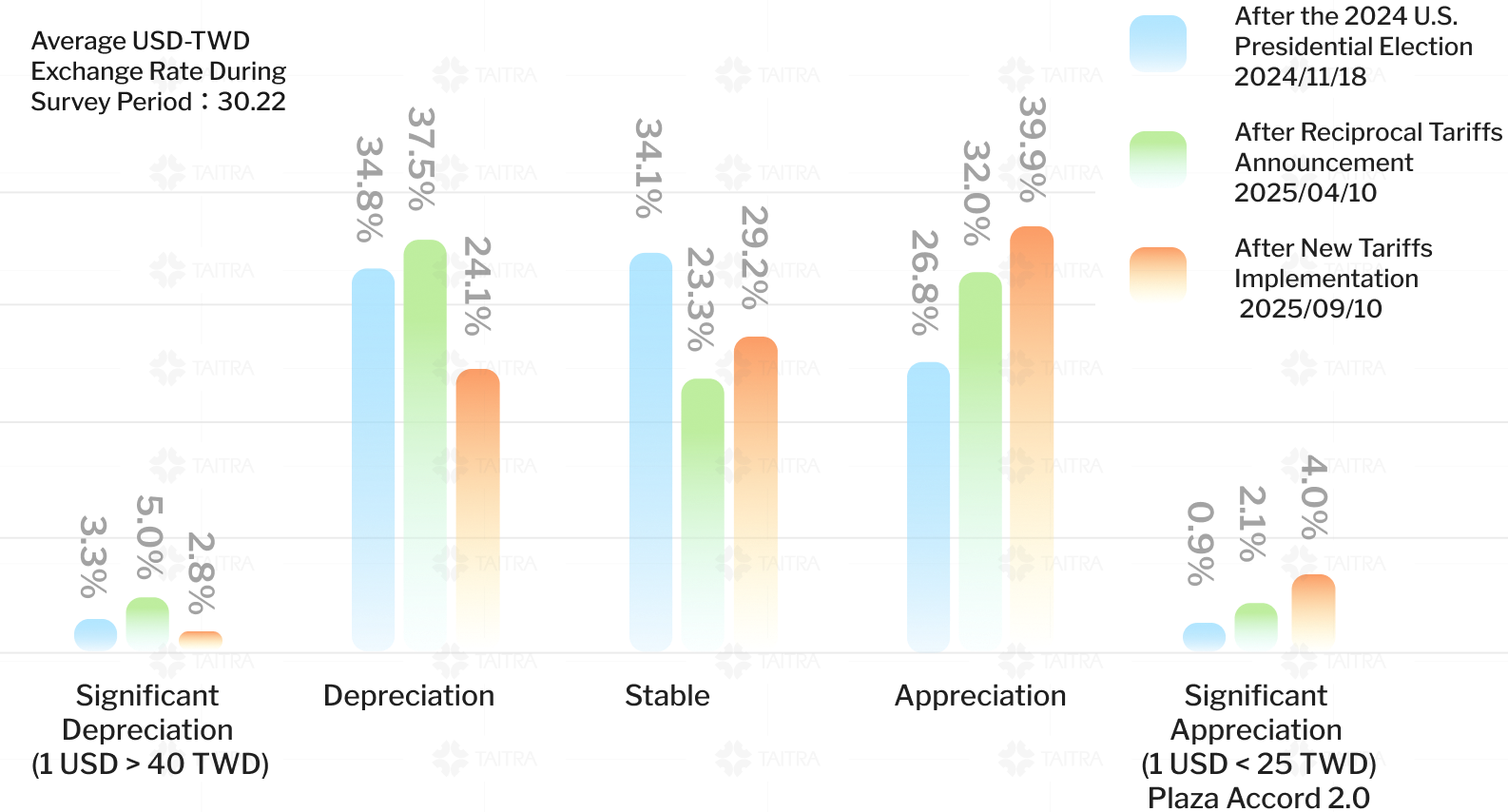

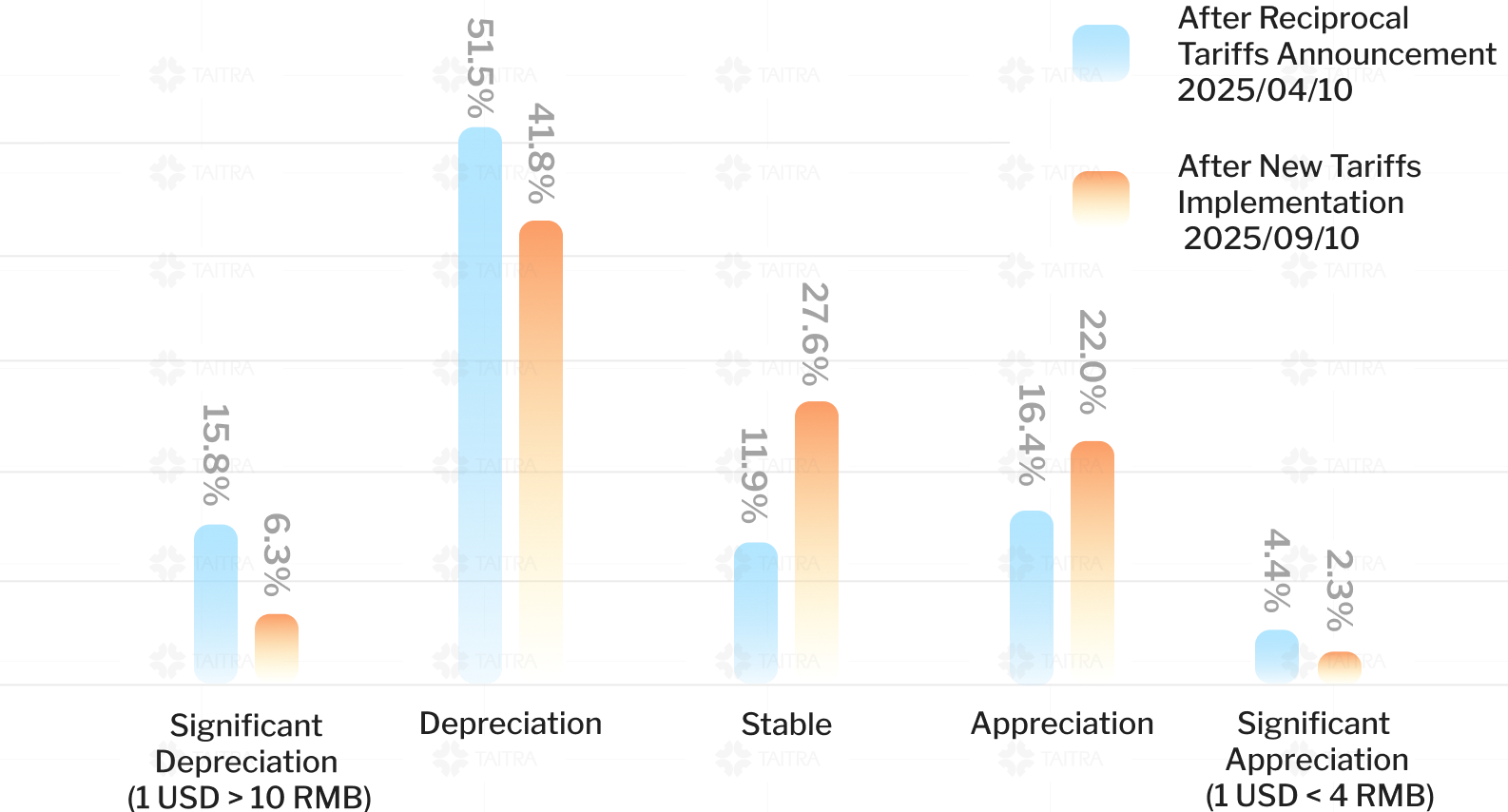

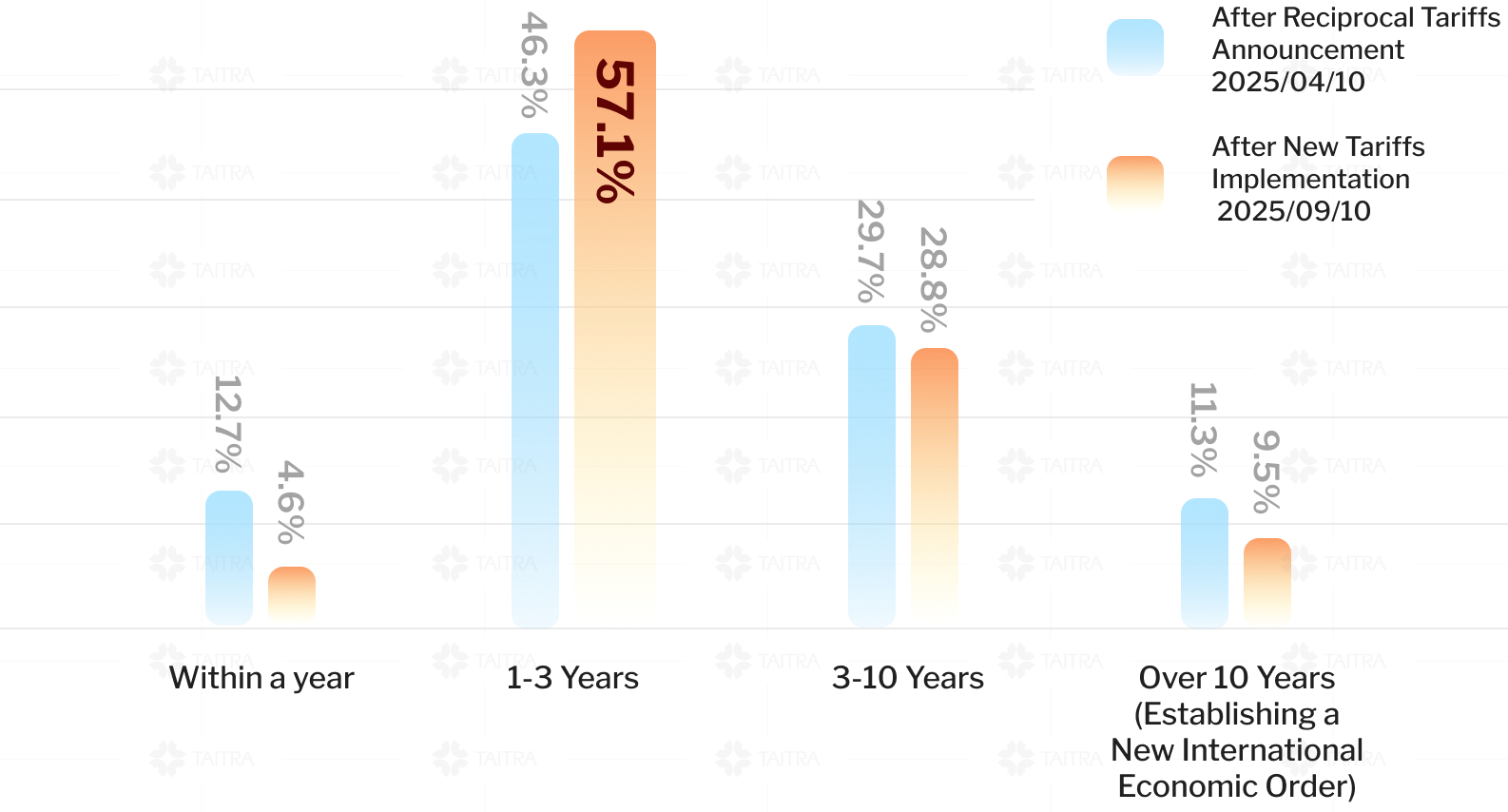

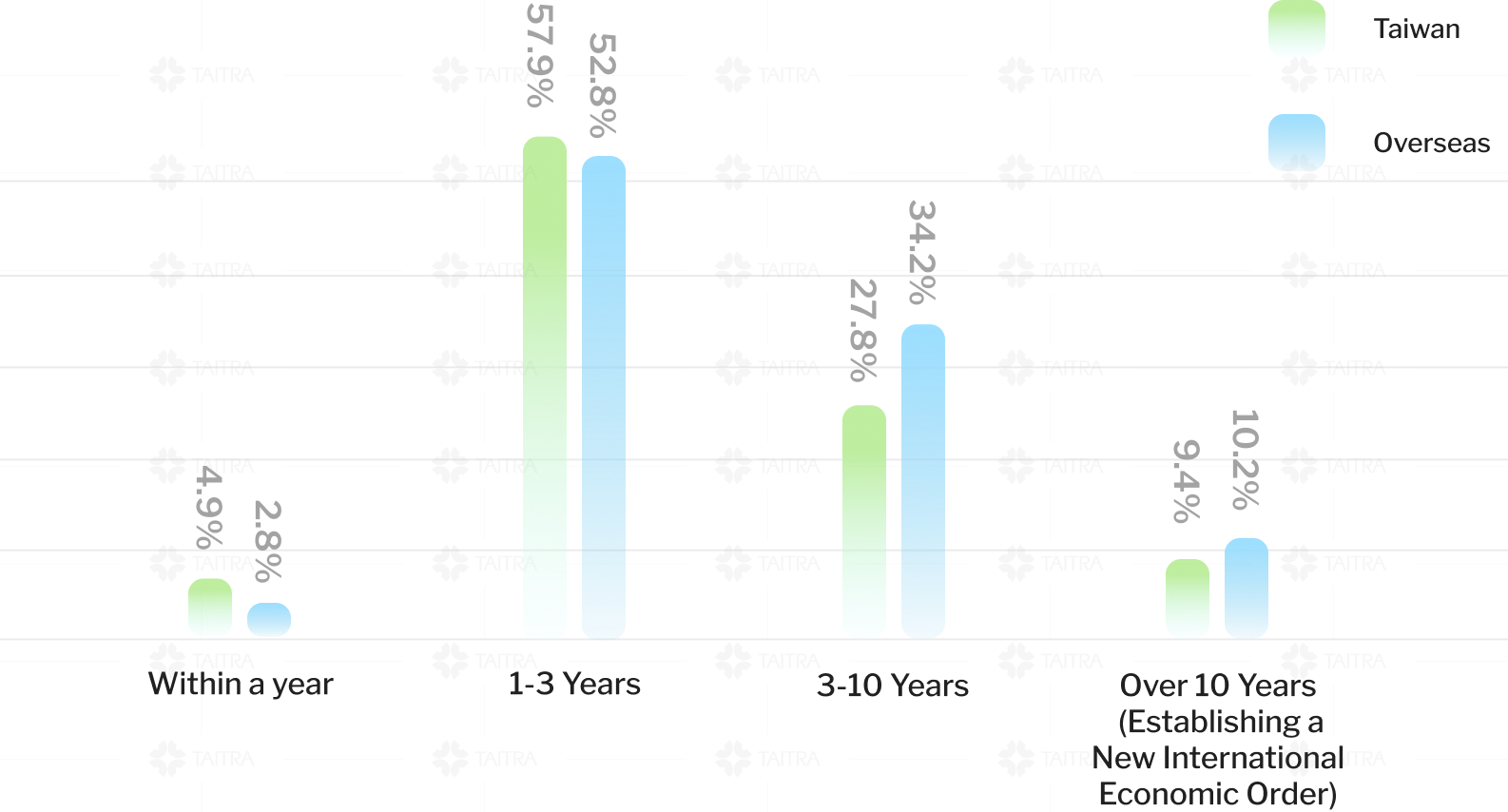

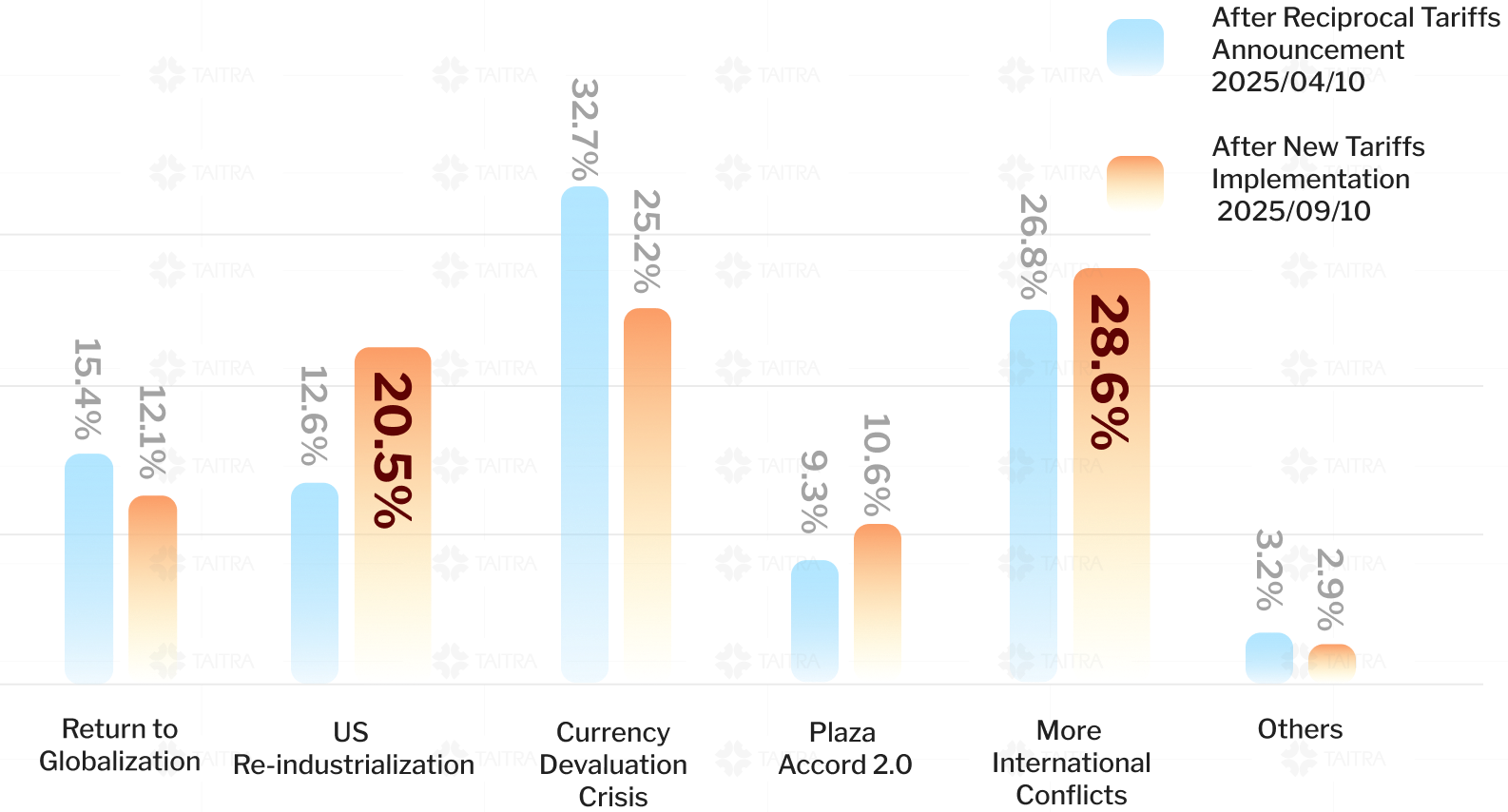

The primary concern has pivoted from currency devaluation to the intensification of international conflicts, highlighting a growing apprehension about geopolitical instability.

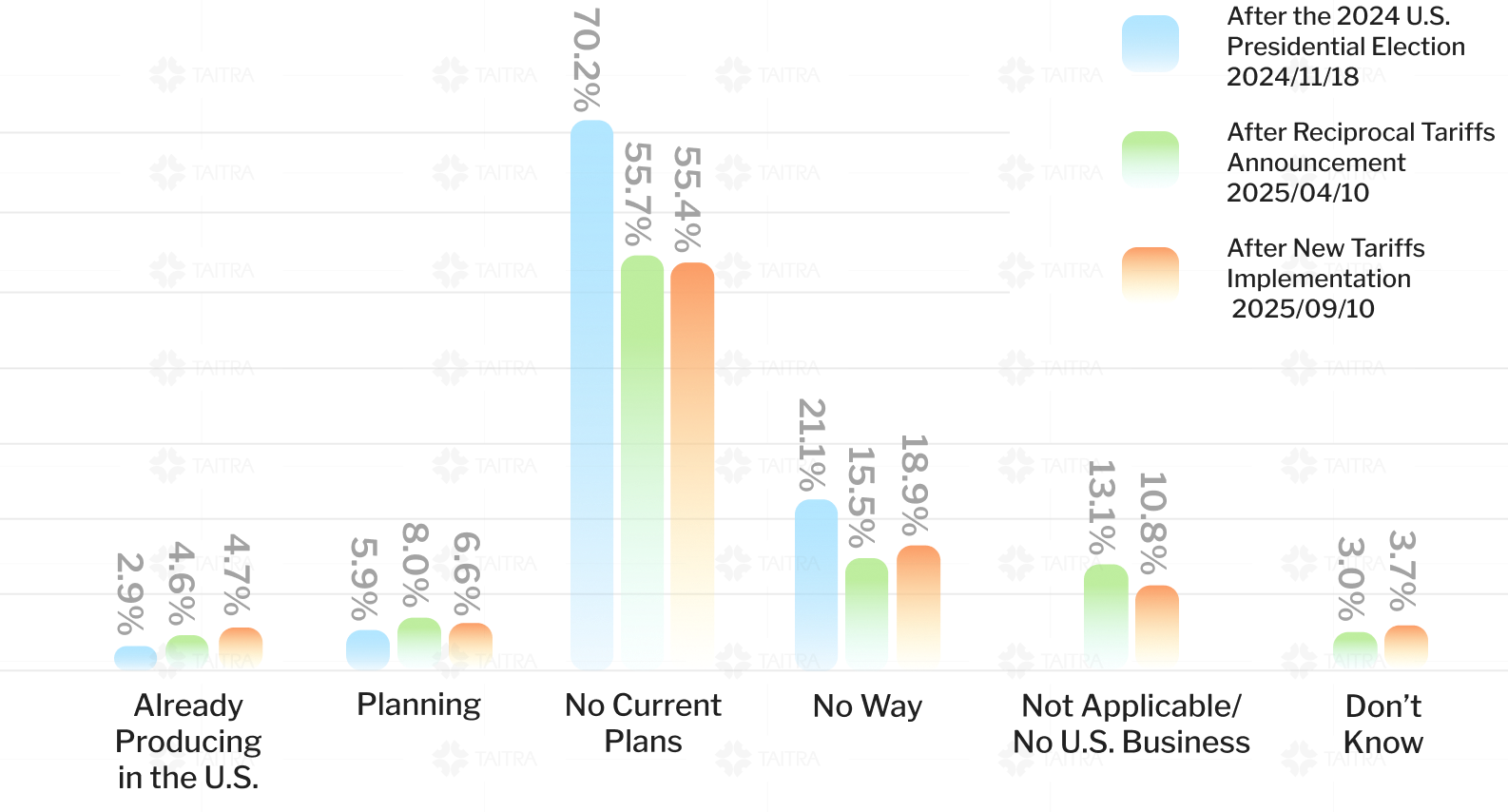

Concurrently, expectations for U.S. re-industrialization have doubled, indicating that Taiwanese businesses are not just reacting to threats but are actively preparing for a fundamental restructuring of the global economic framework.